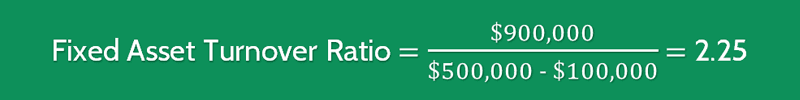

Right, So the higher the ratio, the better, Okay, this one's not too complicated. If we can turn a dollar fixed assets into $5 of sales, that's better than turning a dollar fixed assets into $2 sale. Okay, so generally, with all turnover ratios, we're gonna see that Generally, a higher ratio means that we are being more efficient with those fixed assets, right. We're gonna compare it to the industry average and see how we compare their. What would be a good amount for this ratio? Okay, so we gotta use benchmarking, right? We're gonna compare it to our competitors. Some, some businesses don't have very many fixed assets, so they're gonna have different benchmarks. Um So they're gonna have a lot of fixed assets. A bus company like greyhound busses, they have to have all these busses that cost a ton of money. Again, I've used this example in other videos, the airline industry, right? They're gonna have a lot of fixed assets. Well, you can imagine there's industries that have a lot of fixed assets. So you can imagine this is gonna be different for different industries right here. So how many dollars of sales? How many dollars of sales do we get for each dollar of fixed assets for each dollar of fixed assets. So how do we how do we analyze our fixed asset turnover? Well, what does it tell us? Remember? It's how much of the numerator for each one of the denominator. Okay, so if they just say fixed assets are 100,000, that will be your denominator. And remember if they only give you just one number, they don't give you a beginning and ending balance, We'll just use that number.

#Fixed asset turnover ratio plus

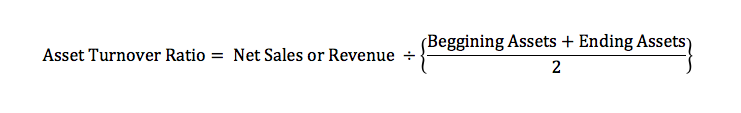

It's always calculated as this beginning balance plus ending balance divided by two. Okay, that's how we always calculate our average balance. Remember every time we've got an average we're gonna start with our beginning balance, add the ending balance and divide by two. Just like always we're gonna have a division, our numerator has net sales divided by our average fixed assets. Let's go ahead and look at our formula right here. How well are we using our fixed assets? Okay, so fixed asset turnover. While this is going to relate the amount of net sales to guess what our fixed assets, right? Our average fixed assets. So the management do not need to invest its decision making time to chant the way forward for this may result to small change in net sales.Alright here we go. Fixed Asset Turnover Revenue / Average Fixed Assets. Numerator factor This factor is represented by net sales and the changes that occur in it are majorly from the changes occurring in fixed assets. This decision helps in maintaining the sales value at high levels. The management need to plan to maintain the fixed assets such that efficiency is maintained and where the asset is beyond repair or maintenance, then disposal decision should be made in a timely manner so as to replace the old asset with anew more efficient one. Quality the management has to ensure that the quality of the fixed asset is not compromised and this can be achieved if the management is in a position to identify the best supplier of the assets.ĭepreciation fixed assets under go wear and tear process on usage such that the original efficiency of the asset goes down with time. Non-current Asset turnover Ratio which is expressed asĭemonstrates the level of efficiency with which pure fixed assets contribute towards net salesĭenominator factor Non-current asset, also referred to as fixed asset is in the hands of the management and since there are many logistics involved in its management, the following are the decision making key points the management need to utilize to improve its efficiencyĬost of acquisition the management need to consider the fairest cost price of the fixed assets to be acquired to ensure that net sale/non-current asset ratio improves Applicability of non-current asset Turnover Ratio in Decision Making by Management Net sales for the year ended 31st/12/2020 was $1,200,000Ĭompute the non-current asset turnover ratio and comment on the efficiency of the non-current assetįor every 1.00$ invested in non-current assets, the business generates $1.33 of sales. You were furnished with the following information of Turn Around co ltd for the year ended 31st/12/2020, It should be noted that this proportion displays the proficiency of non-current assets in the business sales level. However, if the total assets are not efficient enough, the corresponding change in sales will be minimal. Non-current assets is the determining factor such that if it is effective in its functionality, then a small change in capital employed will result to relatively more change in the sales level of the firm (holding other factors such as selling price constant). In this case, we are not factoring the contribution from current assets. This refers to level of contribution made by pure non-current assets towards sales or turnover generation.

What is Non-current Asset Turnover Ratio?

0 kommentar(er)

0 kommentar(er)